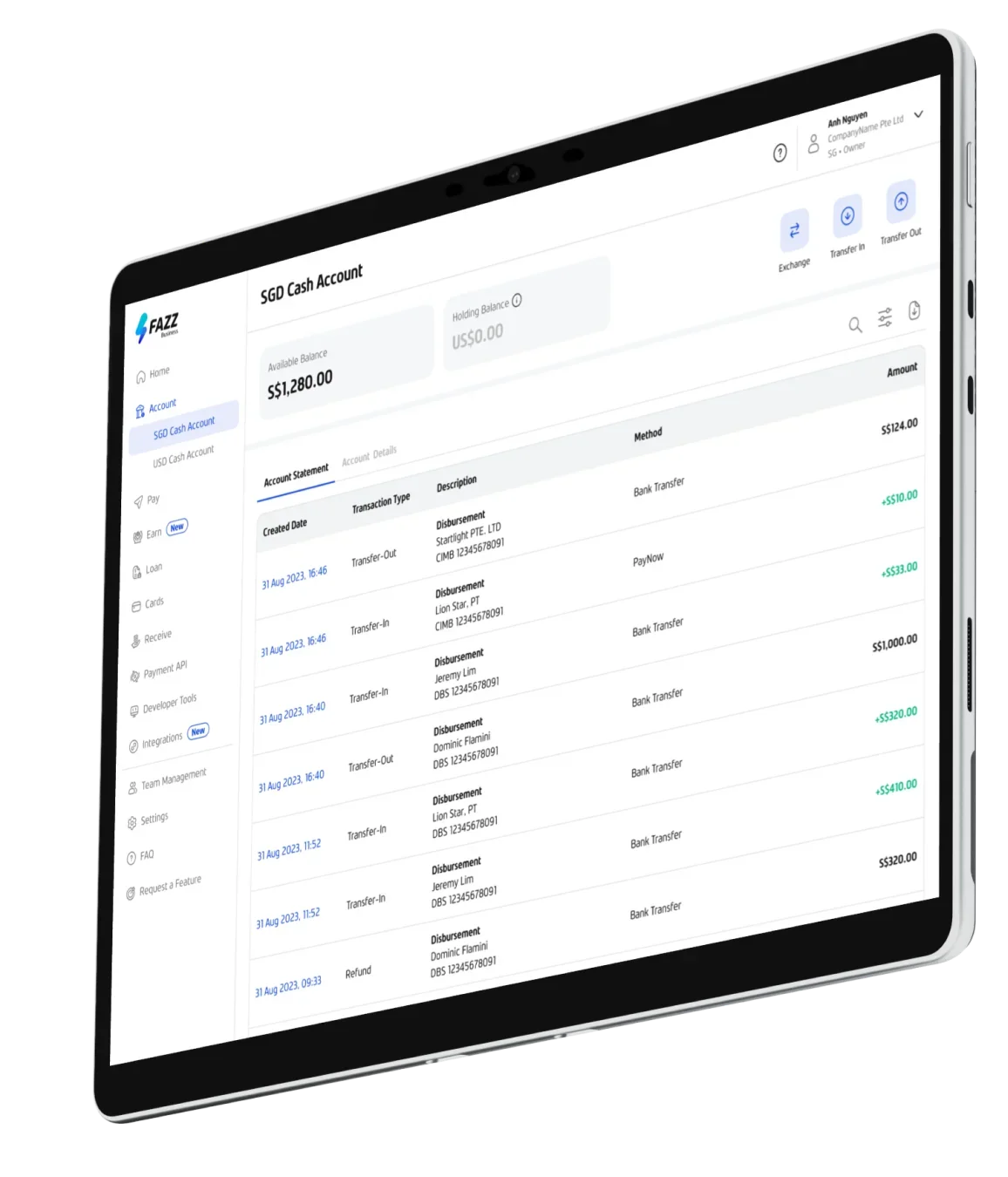

Xfers is now Fazz Business. Read more

© 2023 FAZZ, Inc.

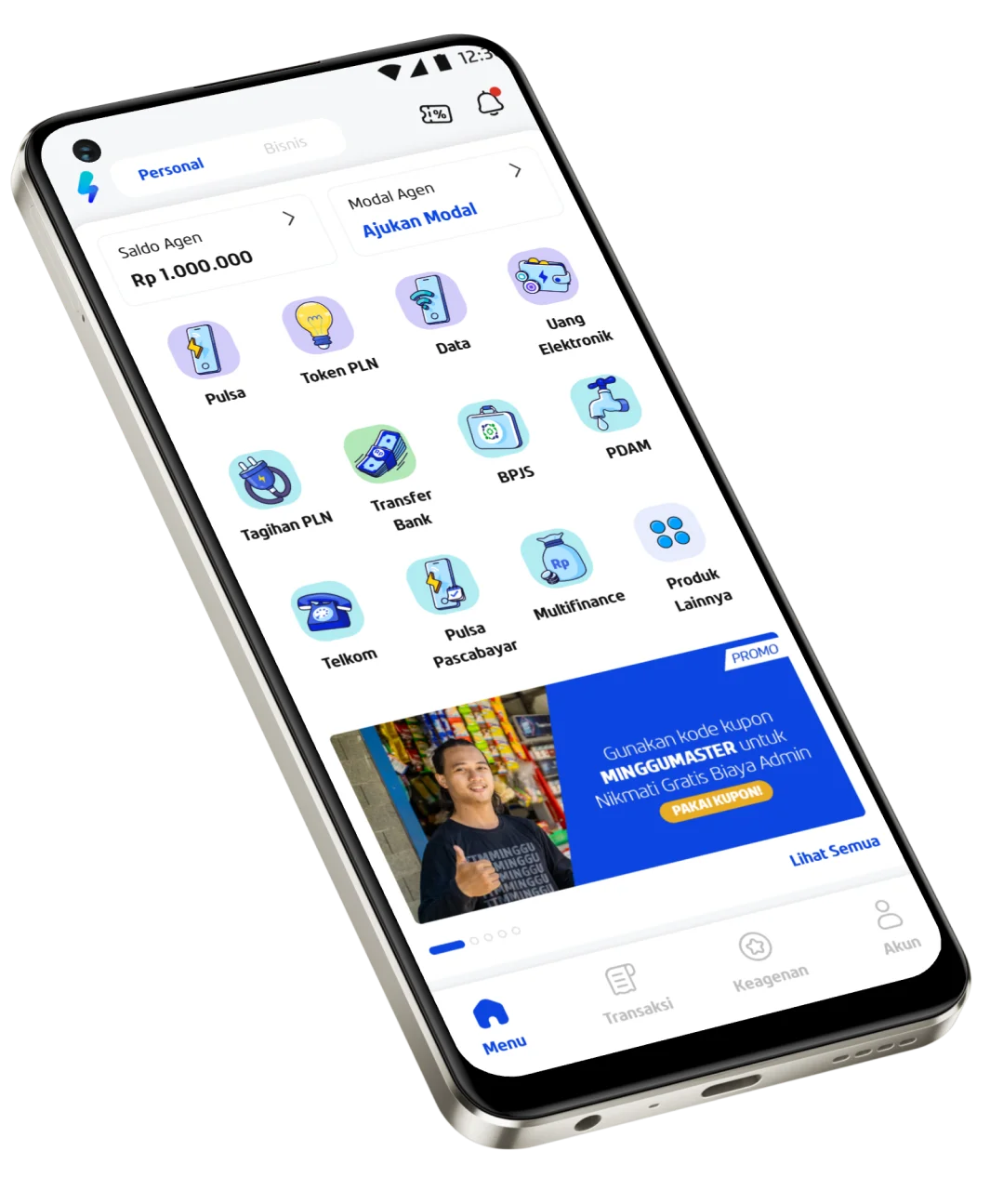

Indonesia

Singapore

Please wait while you are redirected to the right page...